r&d tax credit calculation uk

Reforms to Research and Development RD tax reliefs - For expenditure on or after 1 April 2023 the Research and Development Expenditure Credit RDEC rate will. Company X made profits of 400000 for the year calculate the RD tax credit saving.

Everything You Need To Know About R D Tax Credits Astute Tax Accounting Services

Any benefits youre claiming or have just stopped claiming.

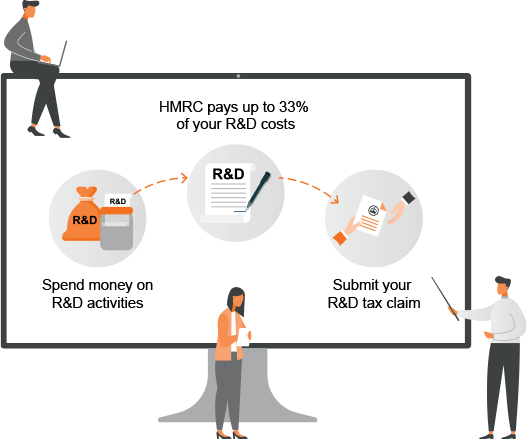

. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. For convenience it makes high-level assumptions. A proposal in UK chancellor Jeremy Hunts autumn statement to overhaul the RD tax credits system for small and medium-sized enterprises.

The qualifying expenditure is 100000 thats already in accounts as expenditure. It was increased to. Self submission or an alternative RD agent.

The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. Supports Profit and Loss making companies. Estimate RD tax relief for your business.

How to calculate the RD tax credit using the traditional method. Award winning RD Tax Consultants Claim RD Tax Credits. Add uplift to your.

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. RD Tax Credits Whether youre new to RD or already claiming RD our team of experts can help you maximise your claim and your use of the credit. Our RD tax credit.

The Treasury owed Britains small businesses more than 84 billion in backdated R. More than half of all the UKs businesses are eligible for RD Tax Credits. Calculating RD Tax Credits for a.

RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base. Youll need details of. RD Tax Credits are a very niche part of the UK tax code that could bring your company thousands of pounds in tax relief.

The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading. The average weekly amount you. Just follow the simple steps below.

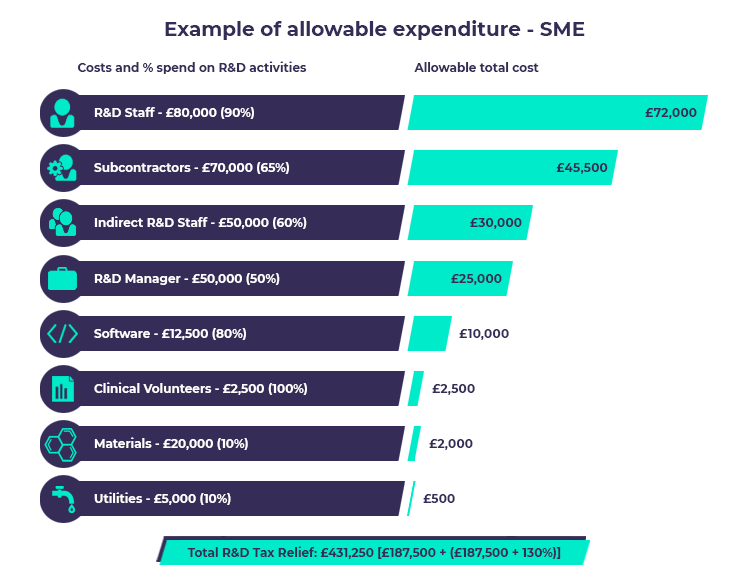

If you spend money creating or improving products or. This calculation example shows how RD tax credits can benefit a company via a tax saving of 9500 and payable tax credit of 39875. Complete all sections to see the potential benefit of a claim.

Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. As a simple example well use an RD spend of 100000 for the purpose of this RD tax credit calculation and apply it to the following steps. RD Tax Credits Calculator.

The RD Tax Credits claim benefit calculator is for estimation purposes only. Calculate your companys RD tax credit claim. Changes to RD tax credits announced yesterday by chancellor Jeremy Hunt are likely to hit small and medium-sized construction firms that rely on the scheme according to.

On this page you can calculate the value of your Research Development tax credits claim. This can be done for the current financial. RD Tax Credit Calculator.

Calculate RD tax relief in under 3 minutes. Select either an SME or Large. Home RD Tax Credits Calculator.

R D Tax Subsidies In Oecd Countries Tax Foundation

How To Enter Research And Development Claims

R D Tax Reliefs Explained Wilson Partners

R D Tax Credits Calculator Free To Use No Sign Up Counting King

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Accountants Research And Development R D Tax Credits Claim For Small Businesses Dragon Argent

How Does The R D Tax Credit S Startup Provision Work Source Advisors

Adp Smartcompliance For R D Tax Credits Youtube

Calculating The R D Tax Credit Randd Tax

R D Tax Credits Explained What Are They Who Is Eligible

R D Tax Credits Claim 33 Cashback On Your Project

R D Tax Credit Calculation Examples Mpa

R D Tax Credits The Essential Guide 2020

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Reliefs Not Just Lab Coats And Microscopes Ppt Video Online Download